What Attorneys Need to Know About Life Insurance “Living Benefits.”

TOLI-5-3-2021-Article03 Jun 2022

In May 2022, I was privileged to present at the NYC Lawyers Association, (NYCLA) regarding the 4 distinct tax advantaged ‘Living Benefits’ that a Traditional or Private Placement Life Insurance policy (PPLI) can provide for the owner of the policy, as well as for the beneficiaries.

I was joined by Martin Shenkman Esq., CPA., and Steve Horowitz Esq., who spoke regarding the proper utilization, design, and trust coordination of PPLI for the ultra-high-net-worth client.

Click HERE for a replay of the webinar.

Click HERE to download the handouts that were provided to attendees.

08 Apr 2022

Here’s a short video I think you might find of interest. This is footage from an episode of the long-running TV business show, Wall Street Week. I was invited by host Anthony Scaramucci to have a conversation about life insurance with John Schlifske, Chairman & CEO of Northwestern Mutual Life Insurance Co.

Join us and see how the TOLI Center East can help you as well as a client more successfully navigate the life insurance landscape.

17 May 2021

Above is a replay of an Executive Summary Presentation given to the NYS Bar Association on May 13, 2021, regarding an advisor’s role in providing guidance to an amateur – trustee focusing on what they need to do as a fiduciary to monitor and maintain a life Insurance policy entrusted to them.

03 May 2021

23 Apr 2021

The misunderstood role of the Trustee/Owner of a Life Insurance Trust is responsible for the increasing number of non-guaranteed life Insurance policies expiring prematurely.

Helping-clients-with-trust-owned-life-insurance30 Mar 2021

30 Mar 2021

Henry Montag of The TOLI Center East and Andrea B. Schanker of Schanker and Hochberg P.C. outline the opportunities and important considerations in estate planning in a pandemic and under a new administration.

Estate-Planning-Opportunities-Under-the-New-Administration22 Dec 2020

Let’s say some of your clients did the right thing and purchased a long-term care contract years ago while premiums were much less expensive. They also did so before many typical medical issues started popping up in their mid 60s. Yes, having a long-term care insurance contract is a wonderful thing. It will provide your clients with the dollars necessary to pay for some or all of their expenses associated with their care.

23 Nov 2020

You’ve worked hard and saved your entire life to be able to enjoy the lifestyle. However any type of an unreimbursed long-term care expense, be it for a mental or physical impairment can of course completely ruin your and your spouse’s retirement plans. After the well spouse and their family gets over the mental shock, and the adjustment to what must now become the new normal, the reality of the situation begins to kick in.

Wealth_Management_July_6_2015_H_PDF23 Nov 2020

Having a long-term care insurance contract will not only provide your client with the dollars necessary to pay for some or all of the expenses associated with their care. Still, it will give them independence and peace of mind, knowing they’ll never be a burden to their kids or spouse.

Accounting_Today_July_8_2015_PDF28 Oct 2020

I was recently honored to have been featured on Annie Jennings’ AuthorExpertWire. Podcast (See Link Below). During the interview, we discussed what we do at The TOLI Center East. which includes educating our clients, be they individuals, business owners, managing trustees, or Attorneys & CPA’s, to help prevent their, or their client’s life insurance policies from expiring prematurely, making them aware of the new ‘Living Benefit’ features that most individuals are Not aware of, and lastly how to get the most value for their premium dollars currently being spent.

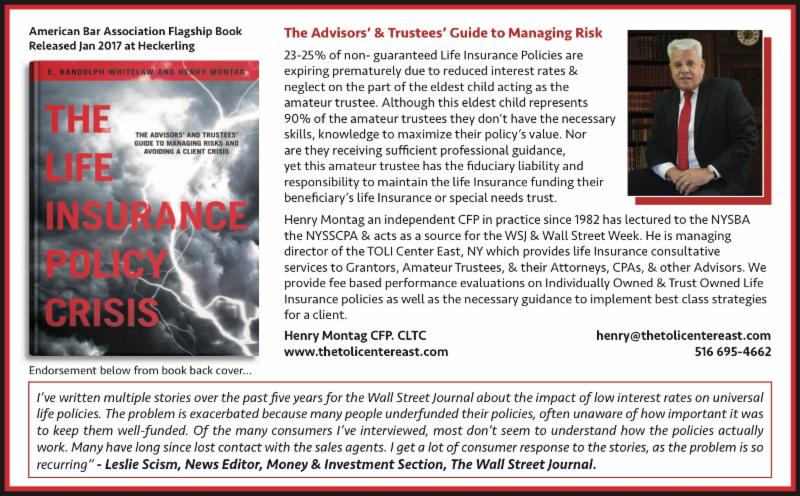

Much of this information is based on an American Bar Association flagship book titled The Advisors’ and Trustees’ Guide to Managing Risk that I was privileged to co-author and which was endorsed by the WSJ. We invite you to call or email to discuss any questions the podcast may have raised

You can view information about this book below or by clicking here.

18 Jun 2020

For Accounting Today, Steve Shorrock and I discuss life settlements, how they work, and how they might be helpful during a pandemic.

Acctg-Today-Life-Sett-June-202010 Mar 2020

Every Retirement plan will have to be reevaluated in light of the new provisions afforded as a result of the SECURE Act effective Dec 20, 2019.

I’m honored to have been asked to cover this important topic for Bloomberg’s Estate Gifts & Trust Journal. March 10, 2020.

Bloomberg-SECURE-Act-Mar-202031 Jul 2019

25 Feb 2019

Loading...

Loading...

29 Jan 2019

Guest blog for Tenenbaum Law, P.C.

Loading...

Loading...

02 Jan 2019

Here is another article I co-wrote with Brett Goldstein for Accounting Today, discussing tax-free withdrawals from a retirement plan for a disability.

Loading...

Loading...

02 Oct 2018

Loading...

Loading...

21 Sep 2018

Read what the WSJ has to say about the subject of prematurely expiring life insurance and why the ABA contracted to have a book about the subject written.

Loading...

Loading...

21 Nov 2015

Loading...

Loading...

08 Jul 2015

Loading...

Loading...